With the Trump Administration’s implementation of tariffs, public discourse has increasingly focused on their impacts on both corporations and American citizens. In this article, we aim to explain (a) what tariffs are and whom they impact, (b) how the historic implementation of tariffs has impacted the US economy, (c) the impacts of tariffs on MNEs, and (d) how MNE can best prepare for the increase in tariffs with some of the nation’s biggest exporters.

What are tariffs and who do they impact?1

A tariff is a tax imposed on foreign-imported goods and services, paid by the importing business to the government where the business resides. There are three main types of tariffs imposed:

- Ad valorem: these are levied as a fixed percentage of the value of imports. (i.e., 10% of all microchips imported)

- Specific tariffs: these are levied as a fixed amount on each imported good (i.e., $3 on each pair of imported shoes)

- Tariff-rate quotas: these are tariffs that start (or increase significantly) once a certain number of imports are reached (i.e., a 5% tariff once after the first 50,000 tons of coffee are imported)

Tariffs, like any taxes imposed, serve to increase revenue of the government that is imposing the tariff. Additionally, these taxes are sometimes aimed to protect certain national industries (such as sugar and weaponry), ensure that national businesses are protected against artificially low prices that can arise internationally, and aim to provide more ‘fair’ trading practices globally.

However, economically speaking, the impacts of tariffs may extend far beyond the importer paying and the government receiving funds. Oftentimes, the bulk of tariff costs is passed on to the consumer. Additionally, intercountry dynamics may be impacted, or retaliatory tariffs may be enacted.

Let’s look at a basic numeric example of an ad valorem tariff:

Company China sells $100 worth of motor vehicle parts to Company US.

A 10% tariff is enacted on all goods purchased by the US from China.

Company China sells the goods and receives $100, while Company US pays Company China $100, plus $10 to the US government.

Impact of historic tariff implementation on the US economy

Most countries impose some tariffs. Generally speaking, wealthy countries impose lower tariffs than emerging economies. There are several factors that contribute to this reality, though the main incentives are protecting the more fragile industries as they are emerging, and protecting limited other sources of government revenue. The US was no exception to this general economic theory, with The Tariff Act dating back to 1789, signed by president George Washington, to be used as a device that would both protect trade and raise revenues for the federal government.2 The first notable US tariff dates back to 1816, directly following the war of 1812, as there was a fear that the UK would retaliate by flooding the US market with inexpensive goods at a loss to undermine US manufacturing sectors.3 This tariff targeted three classes of duties on imported goods:

- Goods that were already produced in the US (including glass, carriages, and paper).

- Goods that were relatively new US industries (including axes, nails, and buttons)

- Luxury goods that weren’t produced in US.

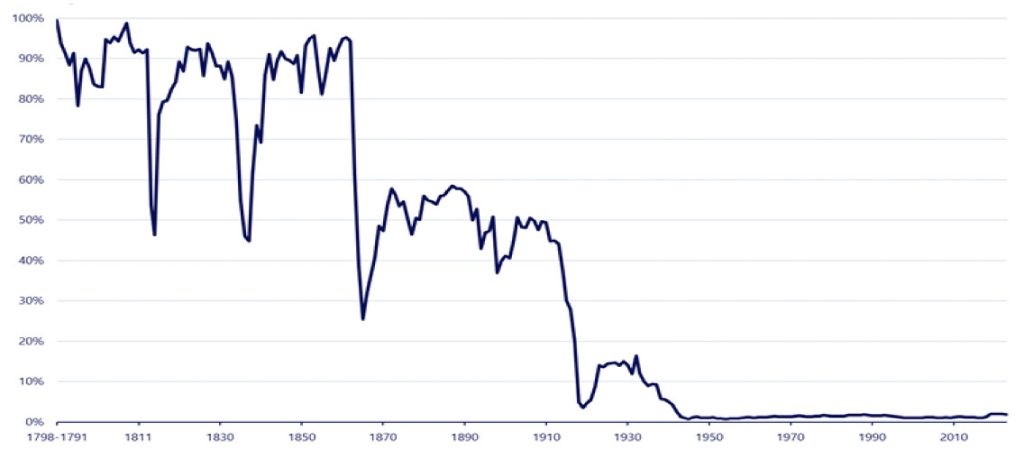

Following this, notable tariff changes occurred in 1913, 1939, 1947, and 1995. Interestingly, each of these tariff changes was followed by a subsequent decrease. Simultaneously, the imposition of higher income taxes and general taxes substituted the need for tariff income, demonstrating a higher level of national economic stability. The following chart shows US tariffs as a percentage of total federal revenue from 1798 to 2023.4

In the present day, the US derives more than half of its international imports from Mexico, China and Canada.5

Potential impact of new tariff implementation on the US economy

The new US tariffs enacted on 4 February 2025 indicated that a 10% tariff would be enacted on all Chinese goods imported to the US. This was met with a retaliation from China, enacting 15% tariffs on coal and liquified natural gas products and 10% tariffs on crude oil, agricultural machinery and large-engine cars imported from the US. As of the time this article was written, tariffs with Canada and Mexico have been put on hold until further negotiations in early March.6

To run a quick materiality analysis: the US imported $438.9 billion worth of goods from China in 2024 of $3,267.4 billion worth of total goods imported, which (at 10%) means that US companies would have paid an estimated $43.89 billion7 to China in retaliation tariffs.

Being that in 2024, a trade deficit of $25.3 billion was recorded with China, and that China is only placing a tariff on a certain subset of US exports, it would be unlikely that the US government collects more on its tariffs on Chinese goods than its corporations paid to China.8

Impacts of tariffs on MNEs

MNEs, specifically those selling products subject to heightened tariffs, will face several difficulties mainly related to managing the increase in intercompany costs of products, decreases in margins earned on an intercompany level, and difficulty supporting individual entity results with traditional benchmarking studies from a Transfer Pricing compliance perspective.

However, not all entities involved in intercompany transactions are at risk, and it is important that pricing strategists, financial preparers and tax managers all consider which entities will actually be affected. For example, limited risk distributors, or contract manufacturers of a MNE should not see any decrease in their intercompany margins, as by nature, their profitability should be determined by an intercompany agreement, with support payments or TP adjustments made be the contracting entity. Contrarily, the entities contracting limited risk entities within a group, full fledge distributors and full fledge manufacturers will be required to reconsider their pricing strategies in light of the new tariffs.

Impact of Tariffs on M&A Activity

From a practical standpoint, the first step any entity should take when assessing the potential effects of new tariffs is to review its supply chain. It is common for new tariffs to significantly reshape the landscape of mergers and acquisitions (M&A) by creating challenges and opportunities for businesses, particularly for those with relevant exposure to multinational operations.

Entities facing increased costs due to new tariffs may seek to merge with or acquire targets with the objective of restructuring and/or relocating part of their value chain. Essentially, these events prompt them to enter (or exit) regions depending on how favorable the applicable trade agreements are. In addition, tariffs can create opportunities for distressed M&A, where struggling companies become attractive targets for acquisition. Moreover, national restructuring initiatives may also take place, taking advantage of special trade zones.

Regardless of the rationale, M&A events will need to be supported by robust taxation-related analyses and compliance considerations, including solid business or asset valuations and sound transfer pricing policies for the resulting structure.

How to prepare for an increase in tariffs

The way companies prepare for an increase in tariffs will vary depending on the industries they operate in, the structure of their corporate group, and the transfer pricing strategies they apply throughout the year to ensure appropriate margins.

At BaseFirma, we strongly recommend that all MNEs begin planning and modeling the impact of new tariffs on their intercompany pricing sooner rather than later. Waiting until mid-year or the end of the year will likely leave entities scrambling to make necessary adjustments before finalizing their local financial statements.

From a transfer pricing perspective, MNEs should consider:

- Supply Chain Realignment: Assessing opportunities to relocate operations to optimize tariff exposure.

- Market diversification: Increase efforts to diversify exports and optimize tariff exposure by leveraging Free Trade Agreements (FTAs) and Special Economic Zones.

- Financial Forecasting & Risk Management: Conduct scenario planning to anticipate risks from potential tariff changes and trade shifts.

- Pricing Adjustments and Transfer Pricing Compliance: Keep in contact with your transfer pricing advisor to identify any room for optimization of existing transfer pricing policies.

In general, we advise MNEs to remain flexible in adjusting their intercompany structures. As modeled finances evolve, it may be necessary to shift from previous structures to maintain profitability.

Ultimately, businesses that take proactive steps to model financial impact, adjust pricing strategies, and adapt supply chain structures will be in a better position to navigate the evolving trade and tariff landscape.

For further information or to discuss the topics covered in this article, feel free to reach out to the authors:

Celina Saffioti – celina.saffioti@basefirma.com

Sandra Amaya – sandra.amaya@basefirma.com

Paul Valdivieso – paul.valdivieso@basefirma.com